The FINANCIAL– While the Equal Pay Act of 1963 improved the earnings of women relative to men by prohibiting wage discrimination on the basis of sex, six decades later women were paid 83 cents for every dollar paid to men, according recent report by to U.S. Department of Labor.

In addition to being paid less when they are working full-time, women shoulder greater family caregiving responsibilities that can require reducing their hours or spending time outside the labor force, thus further eroding their earnings and accruing substantial economic costs. Moreover, gender inequality in earnings also translates into lower income from programs such as Social Security or employer-provided pensions.

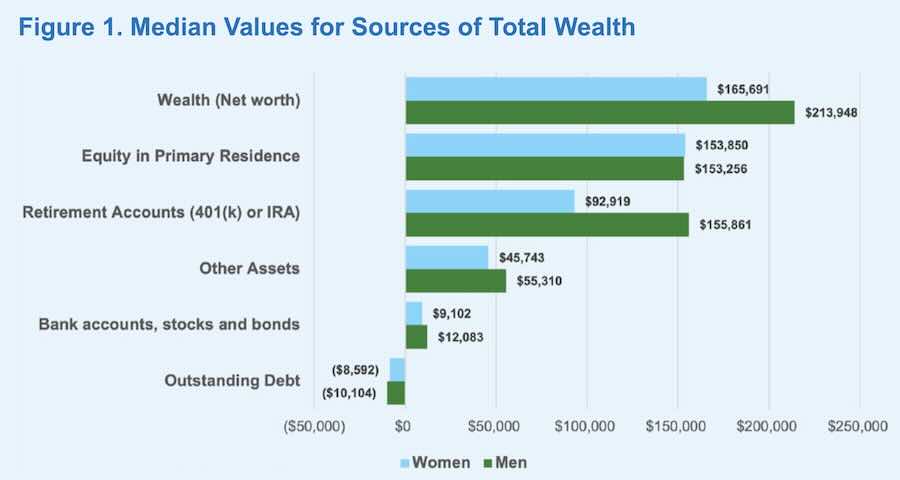

Women’s lower average wealth compared to men’s results from several interrelated factors including wage inequality, disproportionate family caregiving responsibilities that lead to time out of the labor market or periods of part-time work, and lack of access to social protections that promote wealth building. Among older individuals, defined as those aged 50 and older for purposes of this brief, women report 77 cents in wealth ($165,691) for every dollar of wealth reported by men ($213,948) at the median.

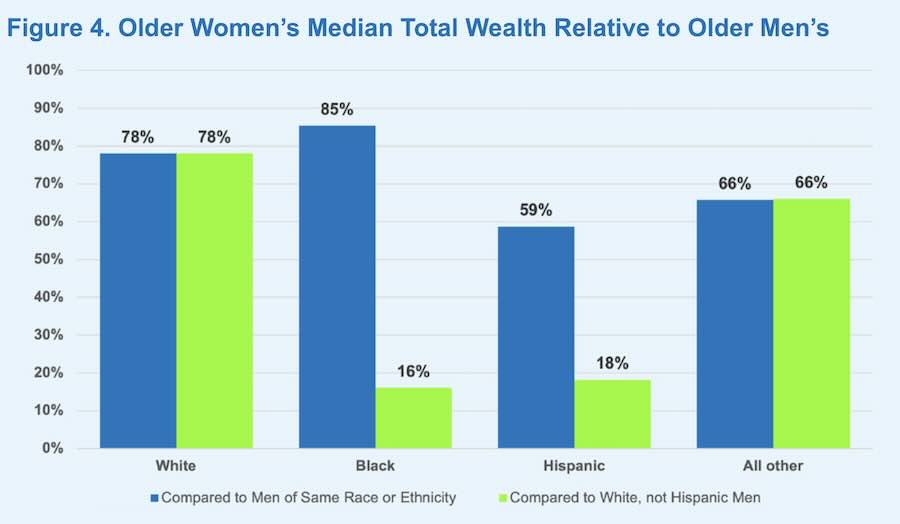

Median wealth ratios for Black and Hispanic women are much smaller: for every dollar of wealth of a white, non-Hispanic man, Black women possess 16 cents, and Hispanic women possess 18 cents.

Much of the overall gender wealth gap is driven by disparate contributions to defined contribution retirement accounts, such as 401(k), 403(b) or individual retirement accounts (IRAs). Women are less likely to have defined contribution accounts than men. Those that do report having only 60% as many assets as men in their accounts: $92,919 at the median compared to $151,861 for men.

These dramatic differences, both in terms of gender and race and ethnicity, reflect in large part cumulative and compounding losses and inequities experienced over a lifetime.

Other key findings from this analysis include:

• The gender wealth gap increases with educational attainment. Among persons with advanced degrees, men’s wealth outpaces women’s wealth by 42% among bachelor’s degree holders and 53% among master’s, PhD and professional degree holders. Much of this gap is driven by the dramatic gender gap in retirement account holdings: women with a bachelor’s degree or more who have a retirement account possess less than half as much equity as comparable men.

• Among persons with a high school diploma or less, men are more likely to have a retirement savings account (32% vs. 26% for women), and those who do have an account have amassed 63% more than comparable women at the median (female-to-male median wealth ratio is 62%).

• Retirement accounts are an important source of wealth for many. However, only about one-third of Black men and women hold retirement accounts, and at the median, Black women’s account balances are only 55% as much as Black men’s ($38,988 vs. $71,023). Among Hispanics, about 25% of women have a retirement account, compared with 34% of men. Hispanic women account holders at the median possess about 70% as much in balance as their male counterparts ($45,016 vs. $64,108).

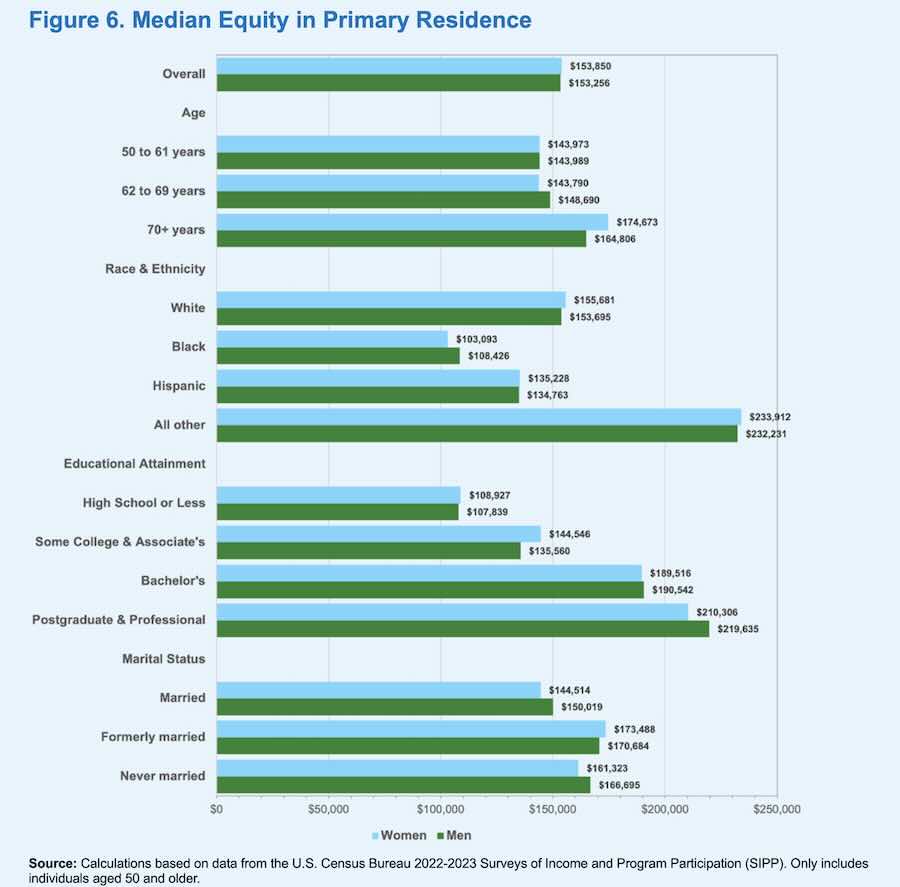

• While equity in a primary residence is a major source of wealth, the amount of equity held is very similar for women and men who own a home. Among never married persons, women are more likely than men to be a homeowner (42% vs. 36%) and among these homeowners, women and men have similar levels of home equity, $161,323 and $166,695 respectively.

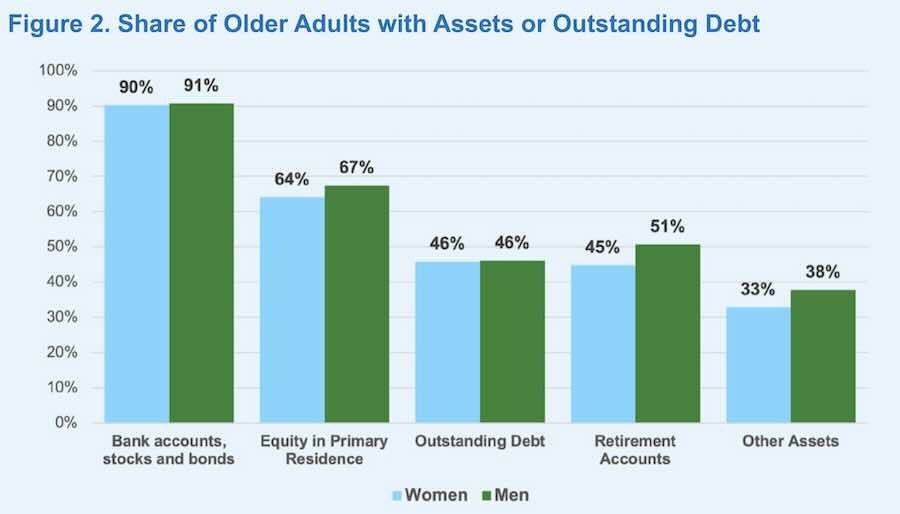

Overall, women aged 50 and older have $165,691 in total wealth compared to $213,948 for men of this age group. Figure 2 reveals that a slightly higher share of older men than older women have retirement accounts (51% vs. 45%) and other assets (38% vs. 33%). Similar shares of older women and older men possess debt, equity in their primary residence, and bank accounts, stocks and bonds. For the approximately two-thirds who own a home, equity in a primary residence has the highest median value of all components of total wealth for older women ($153,850) and are relatively similar for older women and men ($153,256) overall.

The second highest median value for a component of total wealth among older women is money held in retirement accounts ($92,919) for those women who possess one. However, comparable men report a median accumulation of $155,861 in retirement accounts. In other words, the median value reported by older women is only 60% that reported by men. Again, these medians are calculated for those who have any holdings in retirement accounts such as 401(k)s or IRAs, highlighting the importance for employment-based policies to both improve access to plans and wage levels that permit saving for economic security across the life span.

About a third (33% of older women and 38% of older men) hold other assets, such as businesses, rental properties or other real estate besides a primary residence. Older women who own other assets report $45,743 and comparable men report $55,310 for the median value of their holdings in this category. On the other hand, bank accounts, stocks and bonds are commonly held (90% of older women and 91% of older men); however, the median amounts held in these accounts is not large ($9,102 for older women and $12,083 for older men).

Almost half of adults aged 50 and older reported some outstanding debt (46% of women and men), such as credit cards, vehicle loans or medical bills. Older men who have it report higher median outstanding debt ($10,104) than older women ($8,592).

TOTAL WEALTH INEQUALITY BY GENDER, AGE, RACE, ETHNICITY, EDUCATION AND MARITAL STATUS

Both women and men report greater total wealth in the older age groups. Among those nearing retirement ages (50 to 61 years), women report $125,812 compared to $171,898 for men. In the ages where many eligible workers begin to claim their Social Security benefits (62 to 69 years), women report $173,682 in total wealth compared to $222,879 for men. Those age 70 and older report total wealth of $205,503 among women and $261,506 among men. In other words, the median wealth value reported by women in the 50-61 year age group is 73% of similar men’s but slightly greater, 79%, among women and men aged 70 and older.

Older women and men in the white and other race groups (Asian, American Indian and Alaska Native and mixed- race respondents) report higher median total wealth than older Black and Hispanic women and men.

Older Black women report total wealth of $43,994 and older Hispanic women $49,921 compared to $214,201 for older white women and $181,175 for older women of other race groups.

Older Black women report total wealth of $43,994 and older Hispanic women $49,921 compared to $214,201 for older white women and $181,175 for older women of other race groups.

The gender gap in total wealth increases across educational attainment levels: older women with a post-graduate degree hold about two-thirds as much total wealth as comparable men. Moreover, and not surprisingly, total wealth is higher for both older women and men with more education. Among women aged 50 and older, median total wealth roughly doubles between those with high school or less education and those with some college or associate’s degrees, from $67,820 to $153,179. It then doubles again among those with a bachelor’s degree, up to $329,487. The increase reported among those with postgraduate or professional degrees is substantial, but only about 46% higher than women holding a bachelor’s degree at $480,592. A similar pattern occurs across educational levels for older men, but at higher median values.

Currently married older women and men report the highest median total wealth across marital status— $219,782 and $276,876 respectively—both more than twice the level reported by those in the two unmarried groups. Formerly married (widowed, divorced or separated) older women ($104,355) and men ($114,688) report median total wealth that is about half as much as their married counterparts. While for most groups, older men have more wealth than comparable women, this is not the case among those who have never been married: older women who have never married report higher median total wealth ($83,722) than older men who have never married ($65,333).

Inequality in total wealth across gender and race and ethnicity.

It shows older women’s median total wealth relative to: (1) older men within the same race or ethnic group and (2) older white, non-

Hispanic men by calculating older women’s total wealth as a percentage of older men’s. Older women report lower median total wealth than older men from the same race or ethnic group, but the within-group gender gaps are larger for Hispanic and All other races than Black and white groups.

The gaps in total wealth are especially wide using an intersectional lens: older Black and Hispanic women report median total wealth values that are only 16% or 18%, respectively, of the levels reported by older white, non-Hispanic men. These relatively low levels of total wealth leave Black and Hispanic women with risks of economic insecurity after retiring and increase the risk of living in poverty as they age.

U.S. Department of Labor, finchannel.com

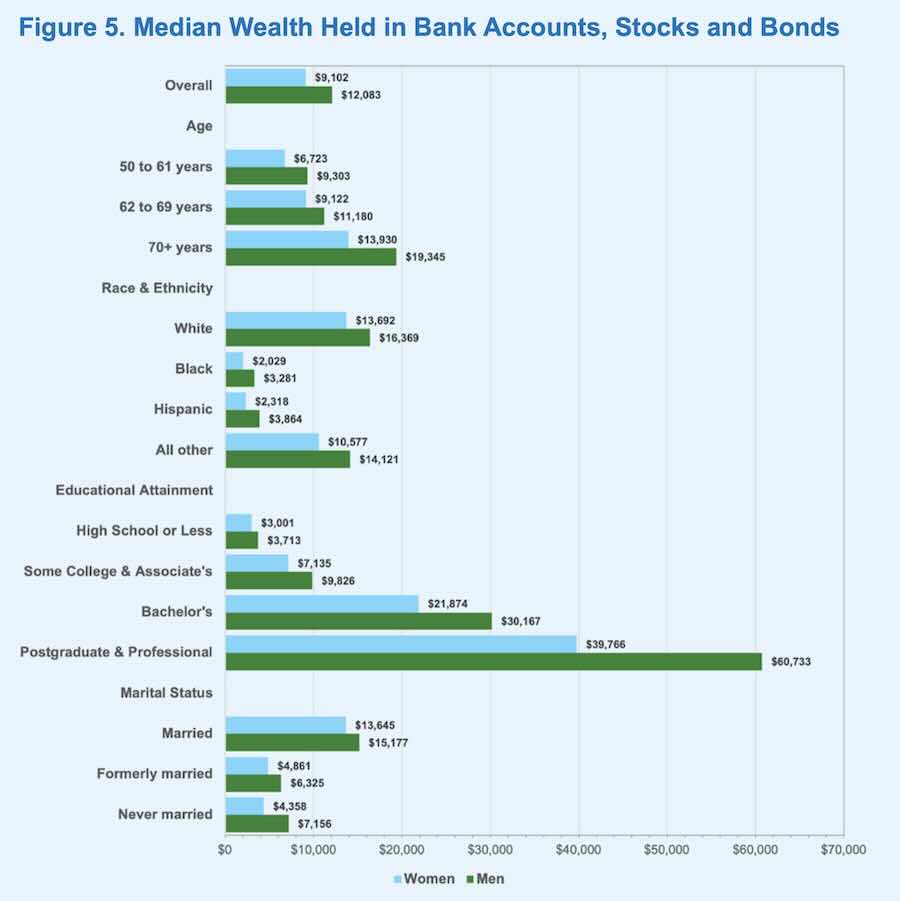

Wealth Held in Bank Accounts, Stocks and Bonds

Wealth held in cash or relatively liquid investments that can be readily converted to cash are included in bank accounts, stocks and bonds. This category includes money held in checking or savings accounts as well as stocks, bonds or mutual funds, excluding those associated with retirement accounts. In the event of an income shock such as an unemployment spell or health crisis that might limit wage income, wealth in these more liquid accounts might provide a cushion or bridge until wages resume or other income sources become available.

The gender gap for holdings in bank accounts, stocks and bonds exists across age groups, with women aged 50 to 61 holding $6,723 (compared to $9,303 for men) and women aged 70 and above holding $13,930 (compared to $19,345 for men). Across age groups, the gender gap in these types of assets is largest for those aged 50 to 61 (women possess 72% as much as men) as well as those aged 70 or older (72% as much), with a slightly narrower gap for those aged 62 to 69 (82% as much).

Racial disparities also impact financial assets: older white women hold $13,692, while older white men hold $16,369. Older Black and Hispanic women possess significantly less ($2,029 and $2,318) compared to older men in those groups ($3,281 and $3,864, respectively) as well as older white women. When comparing older women to older men of the same race or ethnicity, older white women’s bank accounts, stocks and bonds hold 84% of older white men’s. Older Black and Hispanic women fare significantly worse, holding only 62% and 60%, respectively, of the assets held by older men in their same racial or ethnic group. When compared to older white, non-Hispanic men, the disparities are starker. Older Black women hold only 12% of the financial assets that older white men hold, and older Hispanic women hold just 14%.

The gender differences in assets held in bank accounts or stocks and bonds widen at higher levels of education.

Older women with a high school education or less have 81% as much as comparable men: $3,001, compared to $3,713, while those with postgraduate or professional degrees show a large gap, with older women holding 65% as much as older men: $39,766 compared to $60,733.

Older married women hold $13,645 in bank accounts or stocks and bonds, about 90% the amount held by older married men ($15,177). However, the financial holdings are lower and the gender gap wider for formerly and never married older women ($4,861 and $4,358, respectively), who hold significantly fewer financial assets as comparable men ($6,325 or 77% among formerly married and $7,156 or 61% among never married).

Equity in a Primary Residence

Equity in a primary residence is the second most common source of wealth, with about two-thirds of women and men aged 50 and older reporting ownership . Among homeowners, older women and men report similar amounts of equity, with older women holding $153,850 in home equity compared to $153,256 for older men.

Across age groups, home equity is nearly identical for homeowners aged 50 to 61, and similar shares of women and men are homeowners—about 6 in 10. Both equity among homeowners, and the share of homeowners, increases at older ages for women and men. Minimal gender differences exist for those ages 62 to 69, however, men aged 70 and older are more likely to be homeowners (75% vs. 67% for women) and have a bit less equity than women ($164,806 for men who are homeowners, $174,673 for women).

Within racial and ethnic groups, gender differences in equity in primary residence are relatively small, but differences are much bigger looking across racial and ethnic groups. Older white homeowners have significantly more equity (around $150,000) than other groups and are more likely to be homeowners—71% to 74% are. Just under 45% of Black women and men 50 or older are homeowners, and older Black homeowners who are women hold slightly less equity ($103,093) than comparable Black men ($108,426). Older Hispanic women and men have nearly identical home equity, though a smaller share of women (47%) than men (52%) report homeownership. While the gender gaps within race and ethnicity in home equity are small, when compared to older white, non- Hispanic men, the disparities from both gender and race or ethnicity are more pronounced. Older Black women hold only 67% of the home equity held by older white men, while older Hispanic women hold 88%. Older women from all other racial or ethnic groups fare much better, holding 152% of the home equity of older white men.

Older men and women with higher levels of education are more likely to own a primary residence, and typically have more equity in that home than their less-educated counterparts. Gender differences within each educational group in terms of the share owning a primary residence are minimal. The largest gap in ownership is just 4 percentage points and occurs for those with some college: 64% of women 50 and older vs. 68% of comparable men own a primary residence. The gap is similar among those with a postgraduate degree (78% for older women vs. 82% for older men). Older men owning homes with postgraduate degrees hold slightly more home equity than comparable women ($219,635 vs. $210,306), but at lower educational levels, older women homeowners either match or slightly exceed comparable men in terms of equity.

Homeownership varies across marital status, ranging from 79% for married men 50 and older down to 36% for never married men. Equity also varies somewhat among homeowners by marital status. However, there are no notable gender differences in homeownership or equity for married or formerly married persons ages 50 or older. Among the never married, older women are somewhat more likely to be homeowners than men (42% vs. 36%), and older male homeowners have slightly more equity than older women homeowners ($166,695 vs. $161,323).

Retirement Account Balances

Women ages 50 and older are less likely to hold retirement savings accounts than comparable men, and those who do have far less saved than their male counterparts (Figure 7). Overall, older women’s median retirement account balances ($92,919) are 60% of older men’s ($155,861).

Among men and women ages 50 to 61 years, there are small differences (4 percentage points, 51% of women and 55% of men) in the possession of retirement accounts. At older ages, however, men are somewhat more likely to possess them: 44% of men ages 70 and older do, compared with 36% of comparable women. The gender gap in retirement account balances among those who have them persists across age groups, with older women holding from 57% to 60% as much in balance as comparable men.

Gender differences also exist within race and ethnicity. Fewer older white women hold retirement accounts than comparable men (51% vs. 57%), and among those who are account holders, they hold $103,435 – only 60% as much as what older white men do ($172,939). Older Black and Hispanic women hold even smaller amounts. About one-third of older Black men and women hold retirement accounts, and among those who do, older Black women have only 55% as much equity in the accounts as older Black men ($38,988 vs. $71,023). About one- fourth of older Hispanic women have a retirement account, compared with 34% of older Hispanic men, and older Hispanic women account holders have $45,016 compared to $64,108 for older Hispanic men.

Across educational levels, older women are either less likely, or about as likely, as their male counterparts to possess retirement accounts with women and men separated by 4 to 5 percentage points. The biggest gap here is among people with a high school diploma or less: 26% of these women have a retirement account vs. 32% of men. In terms of retirement account balances, large gender gaps exist across educational levels, especially at higher levels of educational attainment. Older women with postgraduate degrees have less than half as much as comparable men: $172,832, compared to $384,231. The pattern is similar for those with a bachelors’ degree as well, with older women retirement account holders possessing 47% as much in their accounts as older men: $128,257 vs. $272,043. While 57% of married men 50 and older have a retirement account, this figure is 51% for comparable women.

There are no notable differences in this measure for formerly married persons, but among the never married, older women are more likely to possess a retirement account than older men: 45% vs. 38%. Older married women retirement account holders have $102,442 in retirement balances compared to $182,806 for comparable men (56% as much). Formerly married ($75,824) and never married ($84,456) older women also hold significantly less than similar men ($100,043 and $122,327, respectively) but the gender gap is smaller than among those currently married.

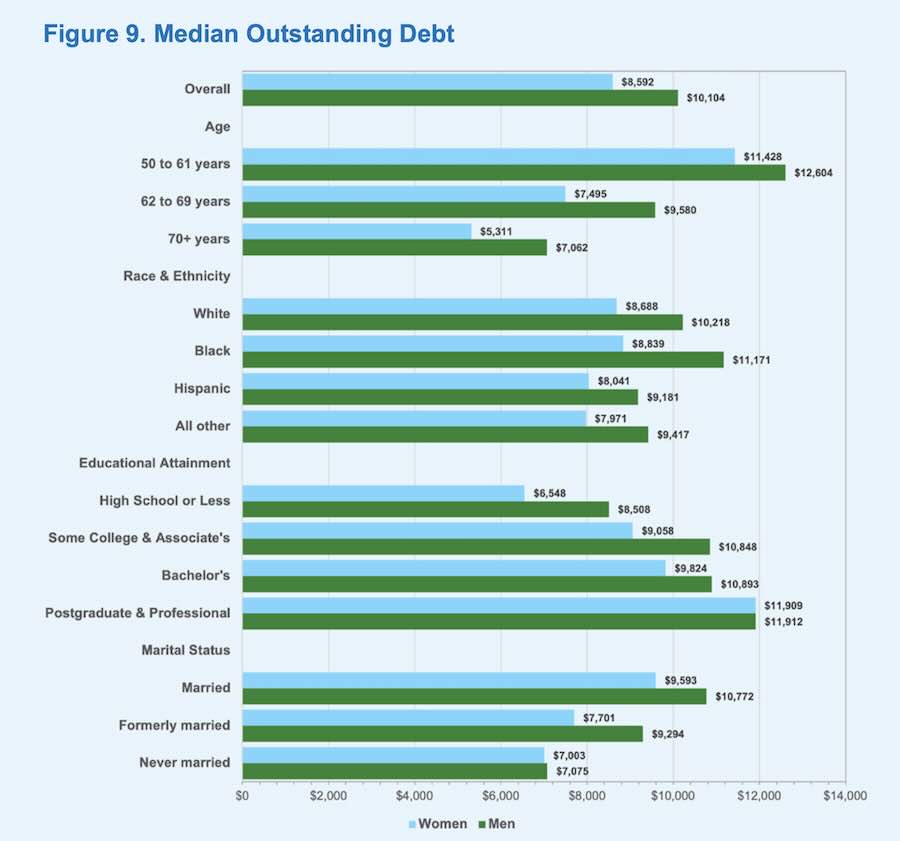

Outstanding Debt

Outstanding debt includes the total amount owed on credit card debt and store bills, the amount of educational debt, an equal share of total debt against all vehicles in which the person owns a share, the amount owed for medical bills, and the amount owed on other debt (excluding a mortgage on the primary residence). Figure 9 shows that older women generally carry less outstanding debt than older men, with overall debt figures of $8,592 for older women compared to $10,104 for older men. There are no gender differences in the overall likelihood of carrying debt among those ages 50 or older.

Carrying debt as one approaches retirement may pose a barrier to economic security. Across the three age groups shown, both women and men report lower median outstanding debt as age increases, but the gender gap widens when looking at the female-to-male debt ratio. In other words, women’s advantage in terms of debt levels increases more than men’s. Women aged 50 to 61 have $11,428 in median debt, while men in the same age bracket have $12,604; that is, women hold 91% as much debt as men. The gap widens for those aged 62 to 69, where women hold $7,495 (78% as much) compared to men’s $9,580. It continues to widen for those aged 70 and above, with women having $5,311 in debt (75% as much) compared to men’s $7,062. While both women and men report lower median debt across older age groups, the drops across age groups are larger among women than men.

Older women of all racial and ethnic categories who carry any debt report less debt at the median than their male counterparts. Older white women hold $8,688 compared to $10,218 for older white men, while older Black women have $8,839 compared with $11,171 for older Black men. Older Hispanic women with any debt hold $8,041, whereas older Hispanic men have $9,181.

In terms of educational attainment, older women debtholders with a high school education or less report $6,548 in median debt compared to $8,508 for comparable men — about 77% as much. Median debt increases but the gender differences narrow at higher educational levels. At the postgraduate level, for instance, older women debtholders hold $11,909, virtually equal to older men’s $11,912 median debt.

Older women report lower median debt in all groups shown for marital status. Older married women report $9,593 in median debt compared to $10,772 for older married men (89% as much). For formerly married individuals, older women report median debt of $7,701 compared to $9,294 for older men (83% as much).

Meanwhile the debt gap is minimal for never married individuals, with older women at $7,003 and older men at $7,075 (99% as much). A larger share of never married older women, though, hold debt – 49%, compared wit 36% among comparable men.

| Percentage of Total Women in the US Population (2021)Annual estimates of the resident population by sex, race, and Hispanic origin for the United States: April 1, 2020 to July 1, 2021[Data set]. National Population by Characteristics: 2020-2022.1 | Percentage of Total Women in the US Population (2060)Table 4: Projected race and Hispanic origin [Data set].2017 National Population Projections Tables3 | |

| White (not Hispanic or Latina) | 59.2% | 44.3% |

| Hispanic or Latina | 18.5% | 27.0% |

| Black or African American | 13.9% | 15.2% |

| Asian | 6.3% | 9.5% |

| American Indian and Alaska Native |

1.3% | 1.4% |

| Native Hawaiian and Other Pacific Islander | 0.3% | 0.3% |