The headlines keep coming in – rents have increased in Indiana, but wages haven’t kept up, even compared with our Midwest peers. And despite their promises, Indiana’s policymakers will never simply build their way out of Indiana’s affordable housing crisis, nor can they attract enough new jobs from other states to make up for the increasing proportion of low-wage, low-quality jobs that don’t pay the rent.

To improve economic and housing outcomes for Hoosiers, Indiana’s elected officials must commit to a new kind of economic development and housing policy strategy that also improves the jobs and homes Hoosiers already have.

The need to focus on Indiana’s existing housing and jobs policies is clear from the new Out of Reach 2023: Indiana report co-released by Prosperity Indiana and the National Low Income Housing Coalition in June. The report finds that while the ‘Housing Wage’ needed to afford the fair market rent of $988 for a two-bedroom unit rose by 12% to $19.00 in 2023 from $16.97 in 2022, Indiana’s average renter wage increased only 7.5% over that time, to $17.86 in 2023 from $16.61 in 2022.

While Indiana’s Housing Wage continues to be significantly higher than the average Hoosier renter’s wage, what’s especially concerning is that an increasing number of the state’s most common occupations no longer pay enough to make rent. In fact, 10 of Indiana’s top 20 largest occupations now don’t pay the state’s Housing Wage, up from nine just a year ago. These 10 occupations, including in-demand jobs like nursing assistants, cooks, laborers, and home health aides, account for nearly 625,000 working Hoosiers and more than a fifth of the state’s total workforce. These occupations are also frequently held by women, Black and brown Hoosiers, and others who also make up Indiana’s extremely low-income renter households that bear the brunt of the state’s housing crisis.

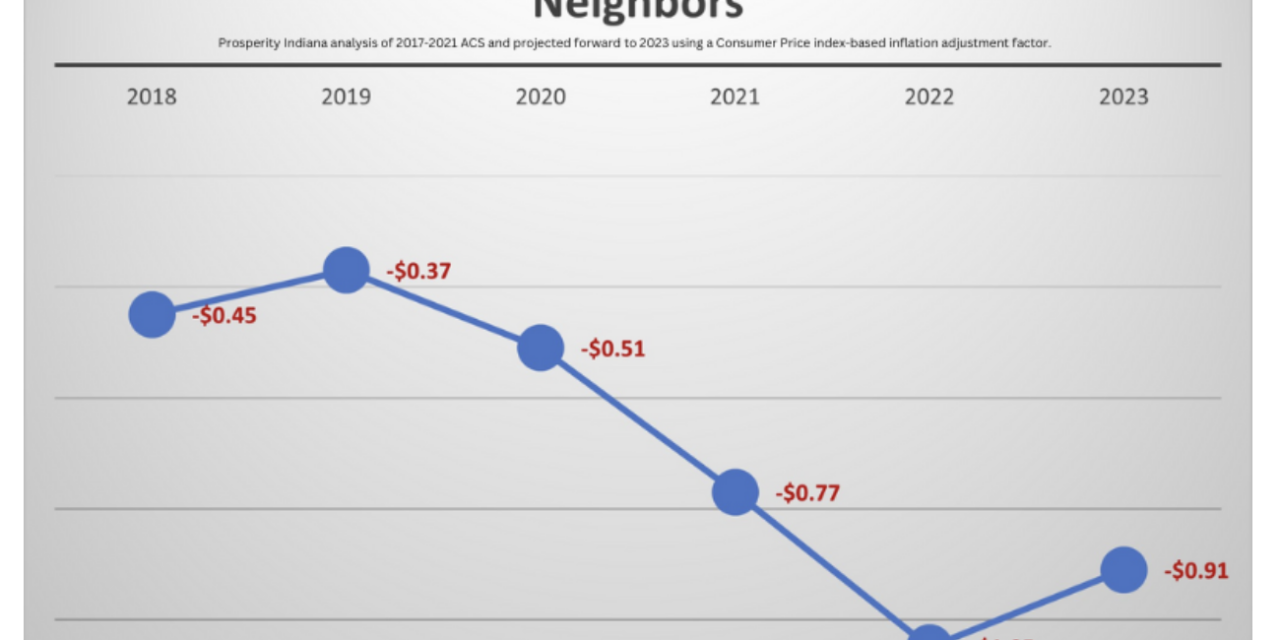

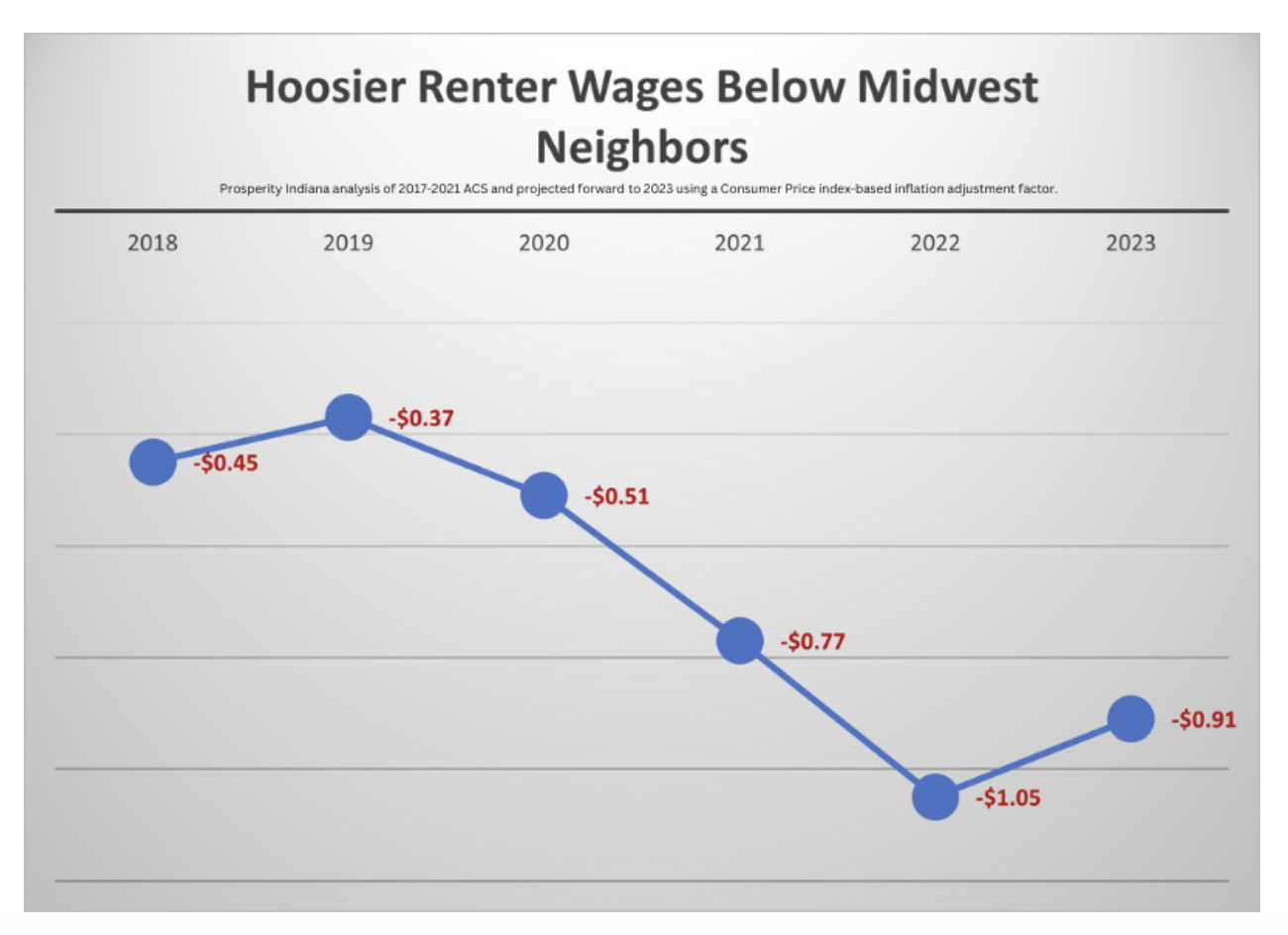

And while housing costs have increased nationwide, Indiana’s lack of competitive wage growth is leaving Hoosiers behind our Midwest neighbors. The mean Hoosier renter wage of $17.86 is now $0.91 an hour lower than the $18.77 average across all 12 Midwest states. This means the typical Hoosier renter working full time makes $1,893 less each year than their typical Midwest counterpart – adding up to nearly two full months’ worth of rent.

A housing strategy that leans on subsidizing already-profitable market-rate housing that Hoosiers with the largest housing gaps can’t afford won’t get Indiana out of its housing affordability crisis. There’s no guarantee that a new-supply-only strategy will ever fill the demand for rentals affordable at the $39,526 annual income that the average Hoosier renter household makes. There’s even less evidence that new developments will cause older stock to sufficiently ‘filter’ down in price to fill the gap of 120,796 units affordable and available for the extremely low income Hoosier households who need them.

The bottom line: Hoosiers can’t wait for housing that magically becomes more affordable and wages that rise on their own. We can’t allow policymakers to lean on market-rate development while at the same time preempting affordable housing solutions, local tenant protections, and court-based enforcement of habitability standards. We can’t let candidates promise more incentives for corporate expansions without doing anything about the stagnant incomes and benefits of the jobs Hoosiers currently rely on to feed their families and pay the rent.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX